In today’s competitive real estate market, having a well-structured marketing plan is crucial for success. As the real estate landscape evolves, staying updated with the latest marketing trends and strategies is imperative to ensure a competitive edge in the dynamic market.

This article will provide ten high-impact strategies and ideas to seamlessly incorporate into your real estate marketing plan, accompanied by real-world examples and case studies to illustrate their effectiveness.

What is a Real Estate Marketing Plan

A real estate marketing plan acts as a strategic roadmap that outlines various promotional activities and initiatives to achieve specific business objectives.

A well-structured marketing plan is the cornerstone of success, guiding agents and agencies through the intricate and ever-evolving landscape of property sales and acquisitions.

Crafting a detailed real estate marketing plan facilitates effective property promotion but also aids in establishing a robust brand presence, providing a crucial competitive edge in the market.

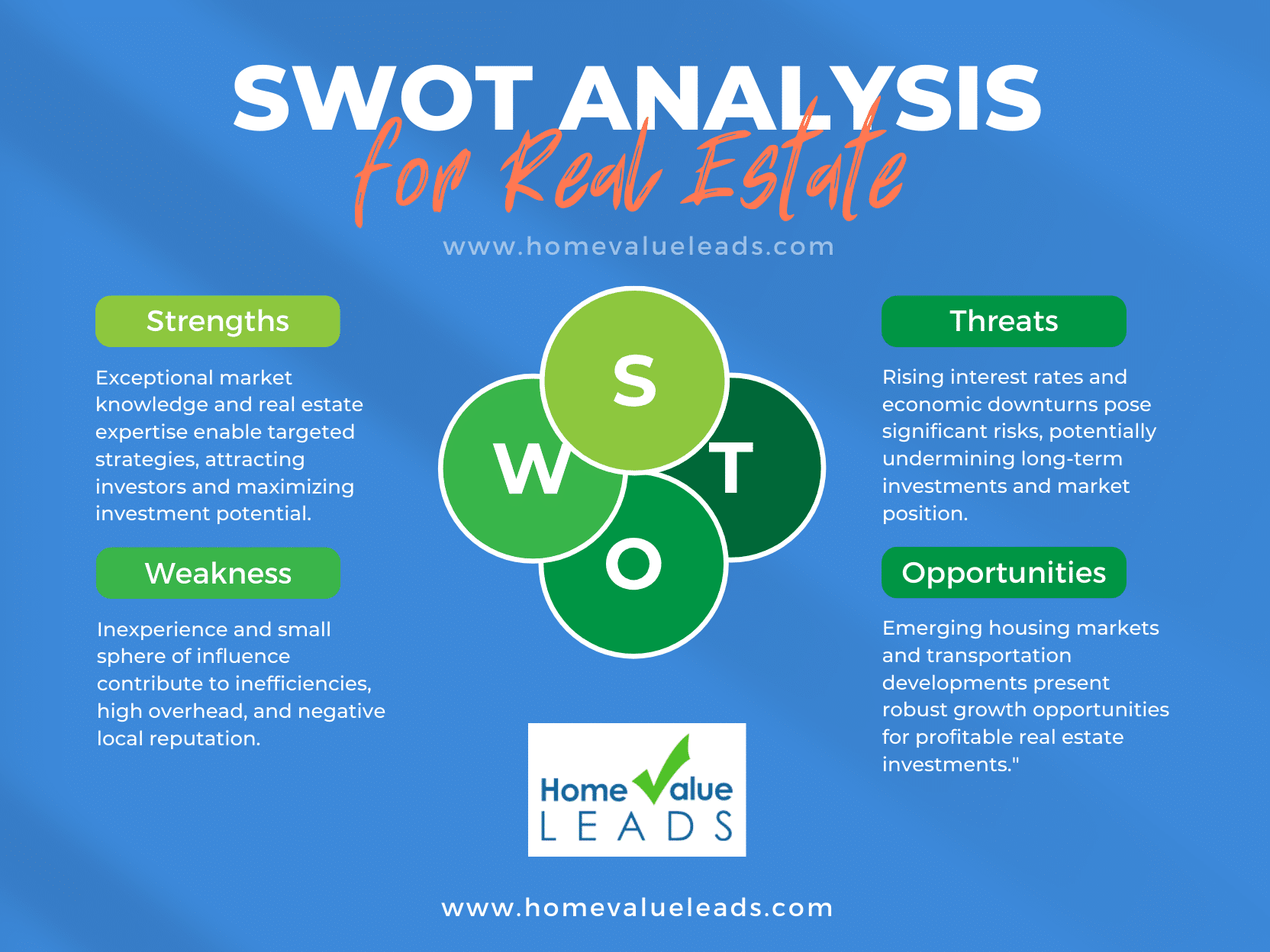

SWOT Analysis

As discussed above, SWOT analysis is pivotal in a real estate marketing plan, offering a comprehensive view of the market landscape and the capabilities of the agent or team involved.

This strategic tool examines Strengths, Weaknesses, Opportunities, and Threats, providing a holistic understanding that guides decision-making and strategic planning.

Here is a breakdown of SWOT analysis within the real estate realm:

Strengths:

Regarding real estate agents or teams, strengths can manifest in various forms. These might include a deep understanding of specific local markets, a well-established network of potential buyers and sellers, or a robust and distinct brand identity that resonates with clients.

For instance, an agent with a long-standing presence in a particular neighbourhood might know the area’s housing trends intimately, enabling them to cater to client preferences more effectively.

Weaknesses:

In real estate, weaknesses can stem from entering new markets without local insights, limited experience in complex transactions, or restricted resource access.

For instance, a newly licensed agent might initially struggle to build a client base due to a lack of a proven track record, emphasizing the need to utilize strong interpersonal skills to build trust and credibility.

Opportunities:

In real estate, opportunities arise from identifying growing neighborhoods, leveraging economic upturns for increased property demand, and adopting innovative technology to streamline transactions.

A skilled agent can establish expertise in promising districts and cater to clients seeking new investment prospects.

Threats:

Real estate professionals must also be mindful of potential threats impacting their operations. These threats may include sudden economic downturns affecting property values and demand, a surge in competitive market activity leading to reduced market share, or changes in legislation that could alter the dynamics of property sales and acquisitions.

For instance, an agent operating in a market experiencing an economic downturn might need to adapt their strategies to cater to a more cautious and price-sensitive buyer pool.

How to Create a Real Estate Marketing Plan

By following a systematic approach, real estate professionals can ensure their marketing efforts are well-directed and yield the desired results. Below is a step-by-step guide to help you develop a comprehensive real estate marketing plan.

Step 1: Audience Segmentation

Knowing your target audience is essential for crafting effective marketing messages. Audience segmentation allows you to tailor your marketing efforts to each specific group.

Goal: Understand your potential clients and customize your messaging to resonate with them.

Action: Segment your audience based on key factors like age, income level, or their position in the buying process, whether they are just exploring options or ready to purchase.

Tools: Leverage customer relationship management (CRM) software and utilize audience analytics to gain valuable insights into your target market.

Step 2: Define Marketing Objectives

Establishing clear and measurable marketing objectives is crucial to the success of your real estate marketing plan. Be sure to outline specific goals that align with your overall business objectives.

Goal: Establish clear, measurable objectives that guide your marketing efforts.

Action: Outline goals such as increasing property listings by 20% or boosting website traffic by 30% in the next quarter.

Tools: Utilize SMART goal templates and refer to performance benchmarks to ensure achievable and relevant objectives.

Step 3: Choose Marketing Channels

Once you have defined your objectives and determined your target audience, it’s time to select the most effective marketing channels to reach them. Consider social media marketing, search engine optimization (SEO), email marketing, print advertising, and networking events.

Analyze your competitors’ successes to identify your real estate business’s most suitable marketing channels.

Goal: Select the most effective platforms for reaching your target audience.

Action: Based on thorough market research and audience segmentation, choose the appropriate marketing channels that suit your goals.

Tools: Employ channel analytics and conduct competitor analysis to identify the channels that align best with your target market and business goals.

Step 4: Create a Content Calendar

Schedule your content release for blogs, social media, and newsletters to ensure compelling marketing messages. Use content management systems and social media scheduling tools to streamline content creation and distribution.

Goal: Ensure consistency and quality in delivering your marketing message.

Action: Develop a content calendar that outlines when and where you plan to release content, including blog posts, social media updates, or email newsletters, to maintain a consistent and engaging presence across various platforms.

Tools: Utilize content management systems and social media scheduling tools to streamline your content creation and distribution process.

Step 5: Analyze and Optimize

Regularly analyzing and optimizing your marketing strategies is crucial for continual improvement and success. Identifying areas where improvements can be made is as important as adjusting your strategies.

Goal: Improve your marketing strategies by staying updated on industry trends, consumer behaviours, and competitor activities.

Action: Regularly review and analyze key performance metrics to assess whether you meet your predefined objectives. Adjust your strategies as necessary to maximize their effectiveness.

Tools: Use analytical tools such as Google Analytics, CRM analytics, and A/B testing software to gather insights and refine your approach for ongoing success.

By following these steps and incorporating best practices, you can develop a robust real estate marketing plan that effectively engages your target audience and drives meaningful business growth.

Tips and Best Practices:

- Conduct thorough market research to understand current trends, customer pain points, and competitor strategies.

- Regularly revisit and update your marketing objectives to align with changing business goals and market conditions.

- Utilize CRM software to manage leads, track customer interactions, and personalize marketing messages.

- Focus on building strong client relationships and providing excellent customer service to generate referrals and repeat business.

- Stay active on social media platforms to build an online presence, engage with potential clients, and showcase your expertise.

- Utilize email marketing campaigns to nurture leads, provide valuable content, and promote new listings or opportunities.

- Continuously educate yourself on new marketing strategies, tools, and technologies to stay ahead of the competition and maximize your marketing efforts.

Marketing Plan for Real Estate Listing

Crafting a marketing plan tailored to individual real estate listings requires a specialized approach that highlights the unique aspects and features of the property.

Unlike a general business marketing plan, a listing-specific strategy delves into the intricate details that make a property stand out in a competitive market.

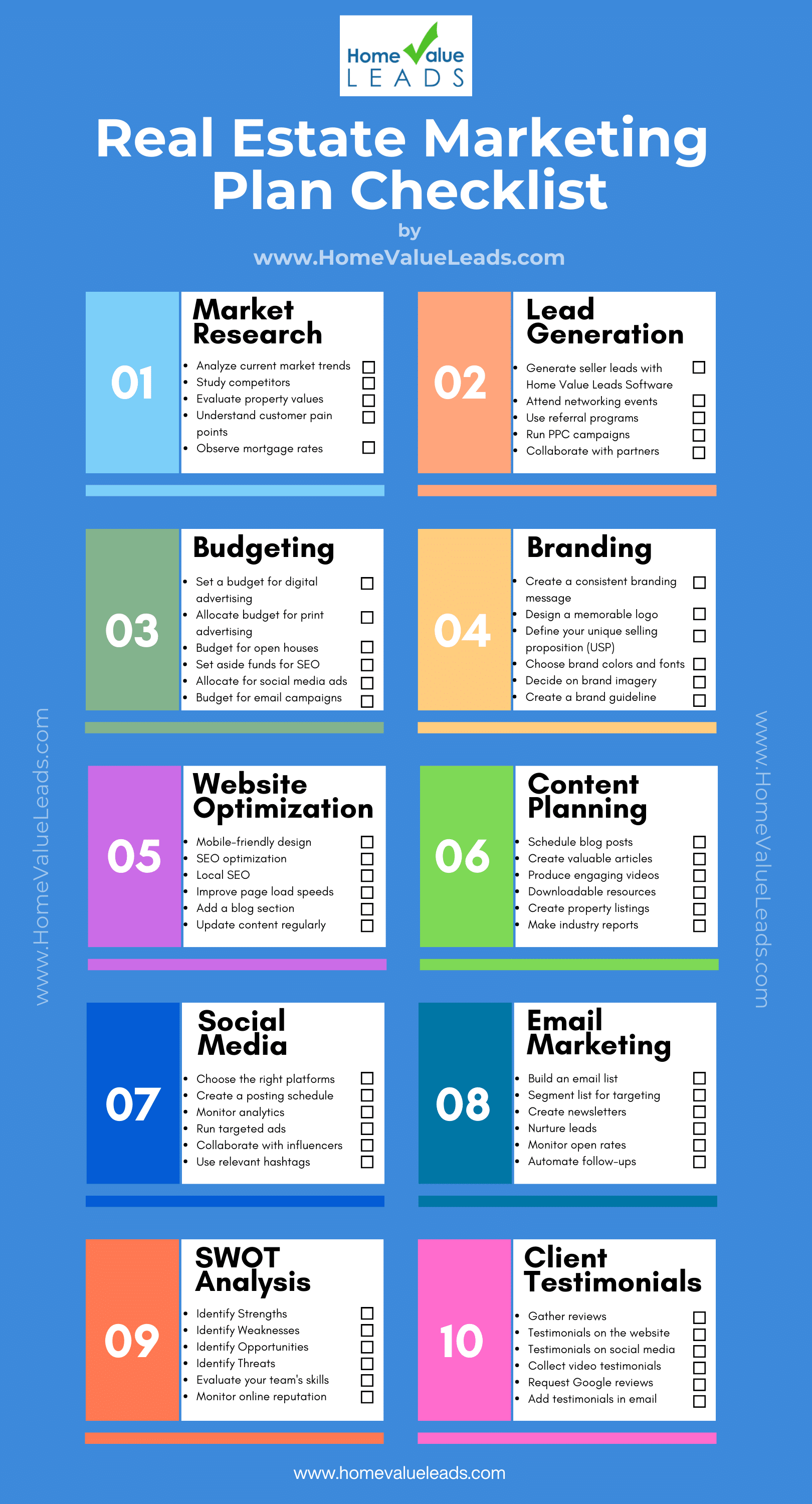

1. Market Research

Market research is an essential component of any real estate marketing plan. Studies have shown that properties promoted based on comprehensive market research have experienced a 15% increase in buyer engagement and a 10% higher closing rate.

This data highlights the significance of market research in enabling real estate professionals to understand the market dynamics, identify customer needs, and position properties effectively to yield higher engagement and successful sales outcomes.

For more information on how to perform market research, you can refer to this content: Real Estate Comparative Market Analysis.

2. Lead Generation

Generating quality leads is a fundamental aspect of real estate marketing. To generate seller leads, you can utilize lead generation software.

Additionally, attending networking events, using referral programs, running PPC campaigns, and collaborating with partners can help generate leads.

To learn more about lead generation strategies, you can explore the following resources:

- Home Value Leads

- How to Get Real Estate Leads

- CRM Software Features

- Real Estate Lead Generation Ideas

- Real Estate Farming

3. Budgeting

Setting a budget for marketing activities is crucial to ensure efficient resource allocation. Allocate funding for digital advertising, print advertising, open houses, SEO, social media ads, and email campaigns.

For example, a recent survey found that real estate professionals who allocated 40% of their budget to digital advertising witnessed a 35% increase in website traffic and a 20% rise in qualified leads within the first quarter.

Proper budgeting allows you to effectively maximize your marketing efforts and reach your target audience.

4. Branding

Creating a consistent branding message is essential for real estate agents. This involves designing a memorable logo, defining your unique selling proposition (USP), choosing brand colors and fonts, deciding on brand imagery, and creating a brand guideline.

Studies have shown that real estate agents with a consistent branding strategy experience a 25% increase in client trust and recognition, leading to a 15% rise in successful property transactions.

Effective branding differentiates you from competitors and helps build trust with potential clients.

5. Website Optimization

A well-optimized website is a powerful tool for real estate marketing. Ensure your website is mobile-friendly and optimized for search engines (SEO).

You can implement local SEO strategies to target specific geographic areas or improve page load speeds, add a blog section to provide valuable content, and update your website’s content regularly to maintain relevance.

For more information on website optimization for real estate agents, refer to the following resources:

- Technical SEO Website Audit & Google Page Experience for Real Estate

- Best Real Estate SEO Keywords & Essential SEO Tools

- Do Real Estate Agents Need Search Engine Optimization?

- SEO for Real Estate Agents: A Beginner’s Guide

6. Content Planning

A strategic content plan can help attract and engage potential clients. Schedule blog posts, create valuable articles, produce engaging videos, offer downloadable resources, create property listings, and provide industry reports.

You establish yourself as a knowledgeable and trusted real estate professional by consistently producing high-quality content.

7. Social Media Strategy

Social media has become a powerful marketing tool for real estate agents, so choosing the right platforms based on your target audience is important.

You can create a posting schedule, monitor analytics to track engagement, run targeted ads, collaborate with influencers in the industry, and use relevant hashtags to increase visibility and reach.

To further enhance your understanding of social media marketing in real estate, consider exploring the following resources:

8. Email Marketing

Building an email list and implementing targeted email marketing campaigns can be highly effective in real estate.

To segment your list for personalized targeting, create newsletters to nurture leads, monitor open rates to gauge engagement, and automate follow-ups to stay on top of potential clients.

9. SWOT Analysis

Performing a SWOT analysis provides valuable insights into your real estate marketing plan. It will help you identify your Strengths, Weaknesses, Opportunities, and Threats.

This allows you to understand your team’s skills, monitor your online reputation, and leverage your strengths while addressing weaknesses and capitalizing on opportunities.

If you want to learn more about SWOT analysis, keep reading!

10. Client Testimonials

Gathering positive reviews and testimonials from satisfied clients can significantly impact your real estate marketing efforts.

Showcase testimonials on your website’s social media platforms and include them in email campaigns.

Collect video testimonials and encourage satisfied clients to leave reviews on platforms like Google.

Customization for Optimal Results

Tailoring each marketing tactic to suit the individual property’s specific features and potential buyer demographic is essential for a successful marketing plan.

By understanding the unique selling points of the listing and aligning the marketing efforts accordingly, real estate agents can maximize the property’s visibility and appeal to potential buyers.

A well-crafted marketing plan for an individual real estate listing showcases the property’s best attributes.

It ensures it stands out in a competitive market, capturing the right audience’s attention and driving successful property sales.

Wrap-up/Conclusion

A well-structured marketing plan is essential for success in the competitive real estate market. We’ve discussed ten impactful strategies: market research, lead generation, and effective branding.

Additionally, we explored how to create a specialized marketing plan for individual listings, emphasizing tailored tactics such as high-quality photography and targeted advertising.

These strategies can enhance your property’s appeal and achieve successful sales outcomes.